ev tax credit 2022 texas

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. If you receive a suspicious call hang up and call our Customer Care Team to verify your account status at 915 543-5970 in TX 575 526-5555 in NM.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Hybrid electric natural gas vehicles model-year 2011-2014.

. Then from October 2019 to March 2020 the credit drops to 1875. You may submit your application via email to TERPapplytceqtexasgov or by mail to one of the addresses below on or before 500 pm CT January 7 2023. Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers.

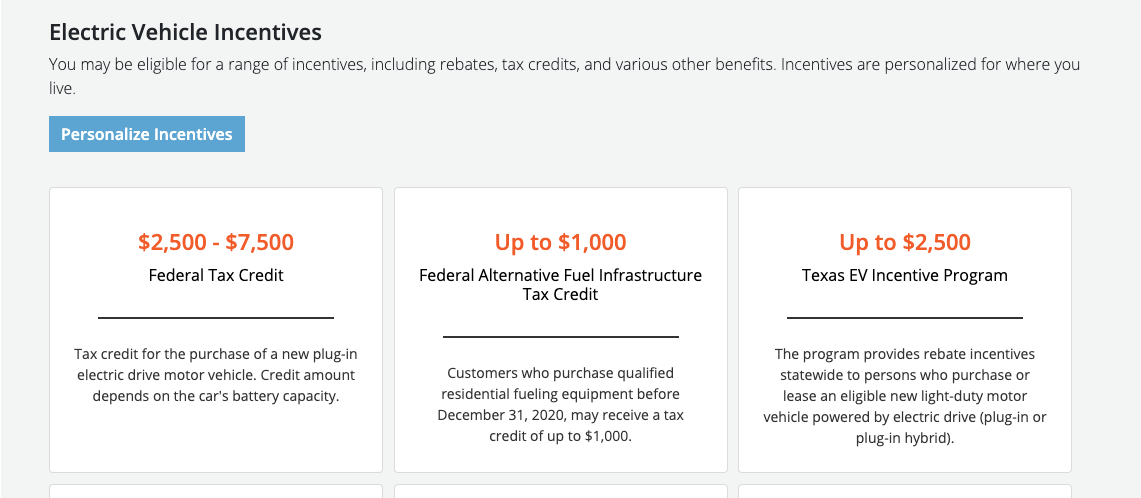

The federal Internal Revenue Service IRS tax credit is for 2500 to 7500 per new EV purchased for use in the US. 50 of purchase and installation costs up to 500. Southwestern Electric Power Company.

250 rebate and a tax credit for 30 of installation costs. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. Federal Tax Credit Up To 7500.

View a list of federal state electric car tax credits incentives rebates broken out by state. Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit.

President Bidens EV tax credit builds on top of the existing federal EV incentive. The renewal of an EV tax credit for Tesla provides new opportunities for growth. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. Updated April 2022. Other states have.

The AirCheckTexas Drive a Clean Machine Program offers up to 3500 toward replacing vehicles that are 10 years and older with cleaner-running more fuel-efficient vehicles such as. Express Delivery Texas Commission on Environmental Quality. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Be aware of suspicious phone calls spoofing EPEs phone number and threatening to disconnect service if payment is not made over the phone. 2022 C40 Recharge Pure Electric. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Regular Post Delivery Texas Commission on Environmental Quality Air Grants Division LDPLIP MC-204 PO.

On or after January 1 2024. IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500. The US Federal tax credit is up to 7500 for an buying electric car.

Box 13087 Austin TX 78711-3087. The size of the tax credit depends on the size of the vehicle and its battery capacity. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline.

Texas EV Rebate Program 2000 applications accepted per year. Pickup trucks model-year 2012-2014. Texas National Electric Vehicle Infrastructure NEVI Plan updated 552022.

Information in this list is updated throughout the year and comprehensively reviewed annually after Texass legislative session ends. Seaport and Rail Yard Emissions Reduction Grants added 3112022. LiFe EV 2011 7500.

Texas state senators are discussing a bill that would charge EV drivers between 200 and 250 for their car each year plus another 190 or more if they drive over 9000 miles. January 1 2020 to December 31 2022. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity. January 1 2023 to December 31 2023.

This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate. Customers who purchase EV chargers between July 2021 to Dec 2022 can receive to 250. Help us share this information to our customers.

Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit. The eligibility standards in Texas Health and Safety Code Chapter 386 and 30 Texas Administrative Code Chapter 114 and must be included on the TCEQ LDPLIP Eligible. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

Texas Southwestern Electric SWEPCO - Residential. XC40 Recharge Pure Electric P8 AWD 2021-2022 7500. Several months later it seems that revisions to the credit are returning to lawmaker agendas.

Cars SUVs and vans model-year 2011-2014. Federal Tax Credit 200000 vehicles per manufacturer. Ford E-Transit 2022 Electric Drive Plug-In 9500 Honda Clarity 2019 2020 Plug-In Hybrid 4059 Hyundai Ioniq EV 2021 Electric Drive Plug-In 4343 Hyundai Ioniq PHEV 2018 2019.

Arizona Tuscon Electric Power TEP. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. 2022 C40 Recharge Pure Electric.

The State of Texas offers a 2500 rebate for buying an electric car. Up to 250. From 2020 you wont be able to claim tax credits on a Tesla.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Learn about EV rebates for California other states. Wheego Electric Cars Inc.

Here are the currently available eligible vehicles. What Is the New Federal EV Tax Credit for 2022.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Sweden Plugin Ev Share 52 In February Kia Niro Leads Cleantechnica

Ford Ceo Jim Farley Expects Ev Tax Credits To Dry Up By Early 2023

Texas Solar Incentives Tax Credits Rebates Sunrun

Tips For Electric Vehicle Drivers In Texas

Incentives Austin Energy Ev Buyers Guide

.jpg)

Latest On Tesla Ev Tax Credit March 2022

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Tips For Electric Vehicle Drivers In Texas

Rebates And Tax Credits For Electric Vehicle Charging Stations

Sweden Plugin Ev Share 52 In February Kia Niro Leads Cleantechnica

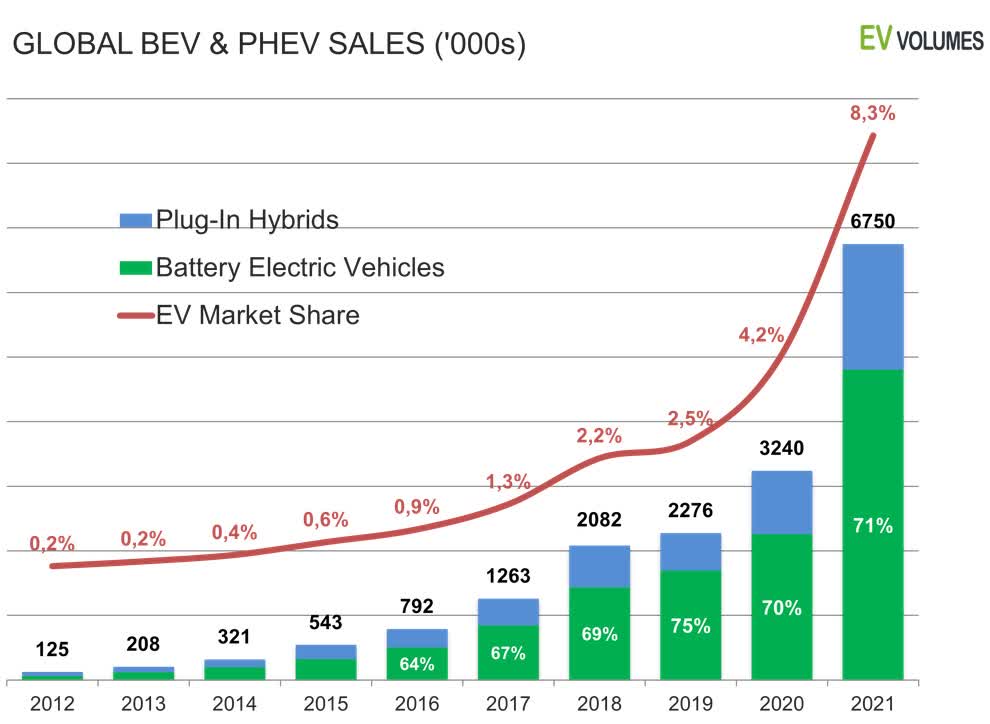

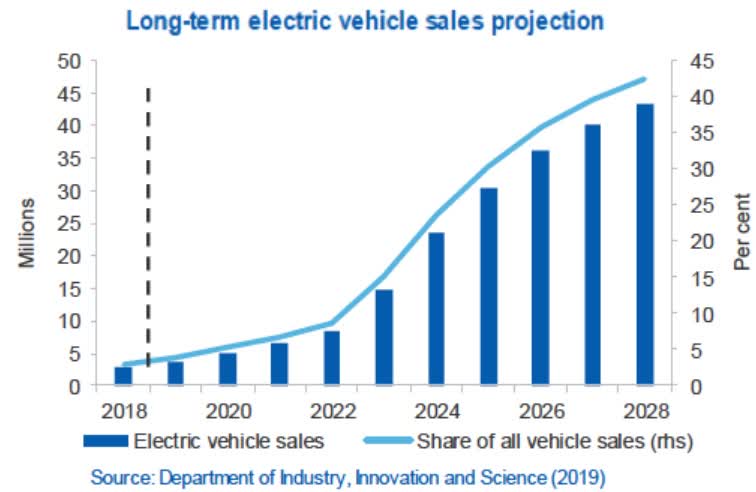

What To Expect In 2022 For Global Electric Vehicle Sales Seeking Alpha

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Latest On Tesla Ev Tax Credit March 2022

What To Expect In 2022 For Global Electric Vehicle Sales Seeking Alpha

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa